richmond property tax calculator

Richmond Hill Property Tax Calculator 2022. Mailing Contact Information.

For all who owned property on January 1 even if the property has been sold a tax bill will still be.

. These documents are provided in Adobe Acrobat PDF format for printing. It is one of the most populous cities in Virginia. For information and inquiries regarding amounts levied by other taxing authorities please contact.

The median property tax in Richmond County Virginia is 673 per year for a home worth the median value of 148700. Box 4277 Houston TX 77210-4277. For comparison the median home value in Richmond County is.

WOWA Trusted and Transparent. These agencies provide their required tax rates and the City collects the taxes on their behalf. Under the state Code reexaminations must occur at least once within a three-year timeframe.

Submit Tax Payments PO. The citys average effective property tax rate is 111 among the 20 highest in Virginia. Formulating real estate tax rates and conducting appraisals.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. The median property tax in Richmond County North Carolina is 732 per year for a home worth the median value of 71300. The average effective property tax rate.

Richmond County collects on average 103 of a propertys. General Correspondence 1317 Eugene Heimann Circle Richmond TX 77469-3623. For comparison the median home value in Richmond County is.

Richmond County collects on average 045 of a propertys. A 10 yearly tax hike is the maximum raise allowed on the capped properties. City of Richmond Hill Flag.

The City Assessor determines the FMV of over 70000 real property parcels each year. The median property tax in Richmond City Virginia is 2126 per year for a home worth the median value of 201800. If you cannot find your assessment notice property owners can visit wwwmpacca and select the Property Owners option at the top menu bar then click on AboutMyPropertyTM or call Access.

For comparison the median home value in Richmond County is. While observing legal restraints mandated by statute New Richmond enacts tax rates. Property Taxes Due 2021 property tax bills were due as of November 15 2021.

Reserved for the county however are appraising property issuing billings taking in collections carrying. Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Richmond County.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. The real estate tax is the result of multiplying the FMV of the property times the real estate tax rate. Along with collections property taxation involves two additional general steps.

Taxing units include Richmond county. The City of Richmond Hill is located in the Regional Municipality of York and is home. Richmond City collects on average 105 of a propertys assessed.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

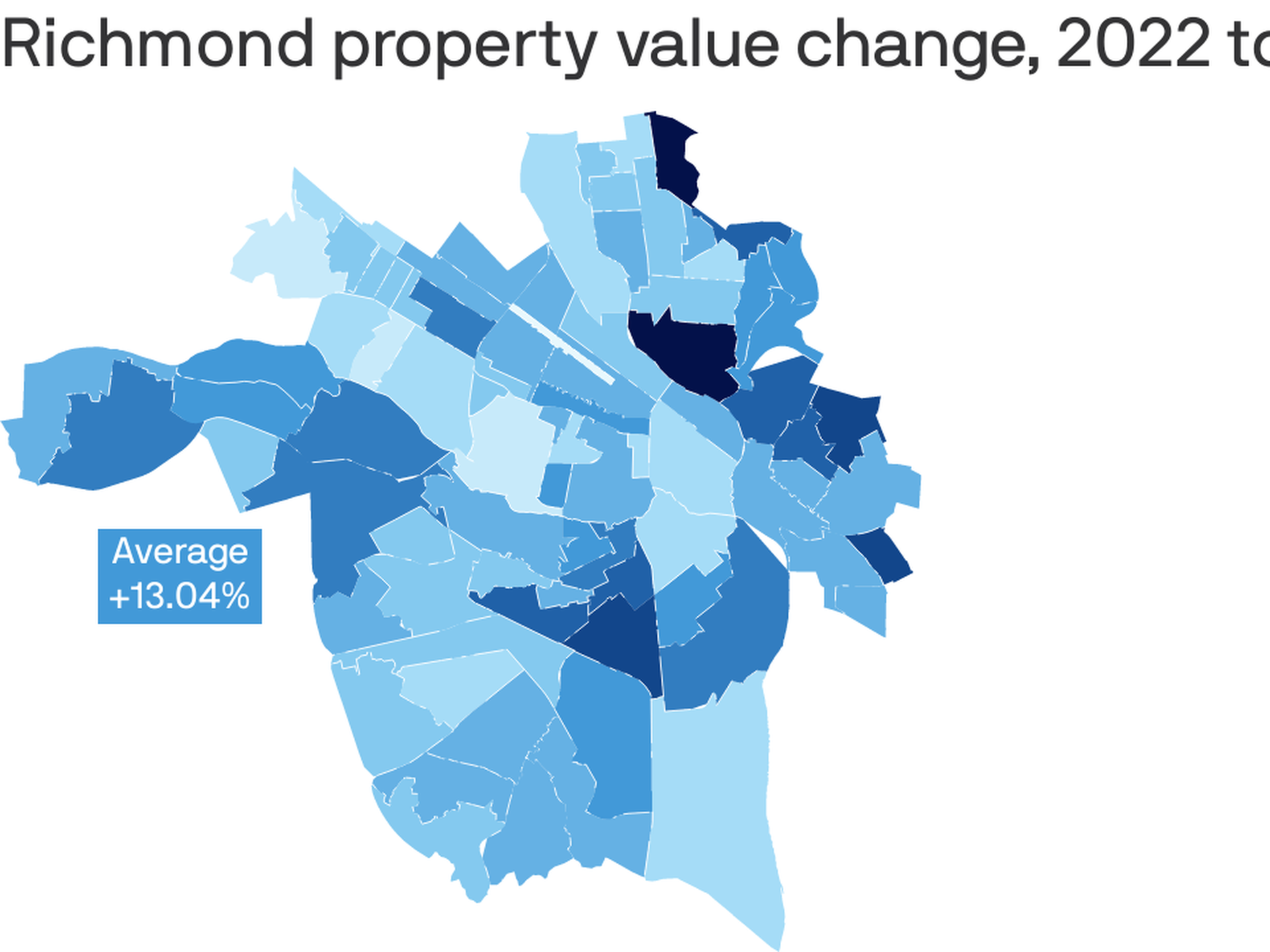

Jump In Richmond Property Values Renews Push To Cut Real Estate Tax Rate Wric Abc 8news

Not All Senior Citizens Still Qualify For Ohio Property Tax Discounts Homestead Savings Calculator Cleveland Com

Where Richmond Property Values Went Up Most Axios Richmond

Your Richmond Va Real Estate Questions Answered

Ontario Property Tax Rates Lowest And Highest Cities

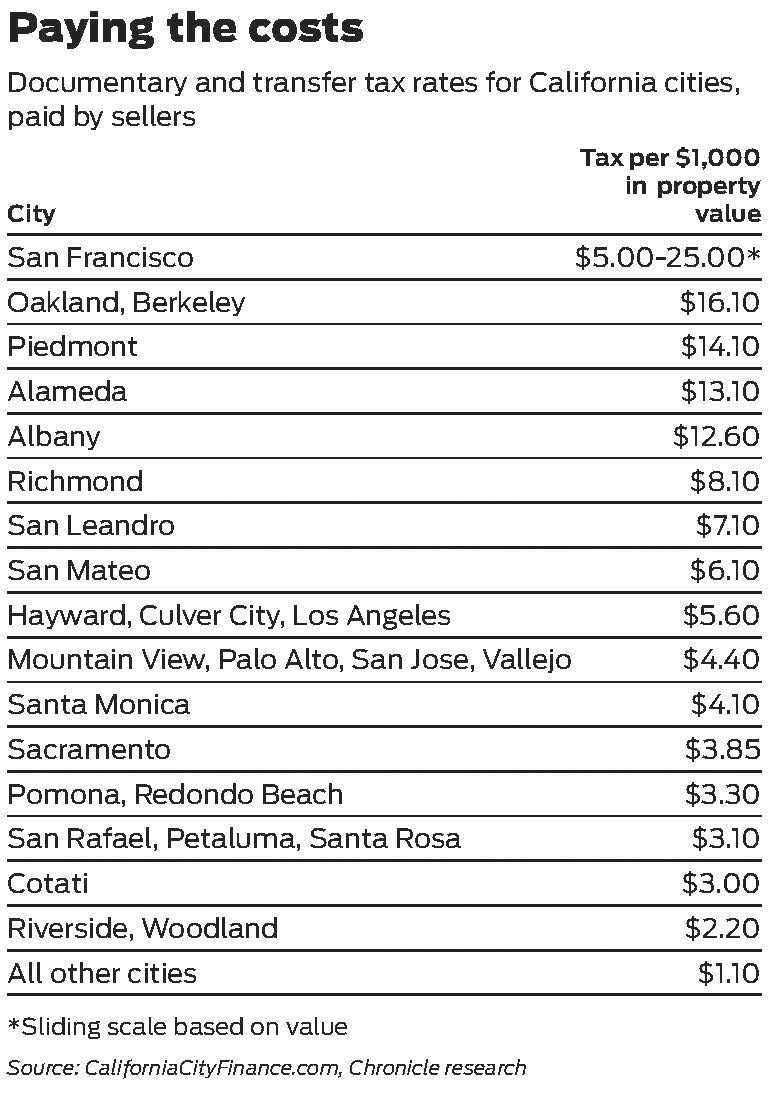

Sf Proposes Transfer Tax Increase On Properties Over 5 Million

2022 Massachusetts Property Tax Rates Ma Town Property Taxes

About Your Tax Bill City Of Richmond Hill

No Increase In Augusta Property Tax Rates Planned

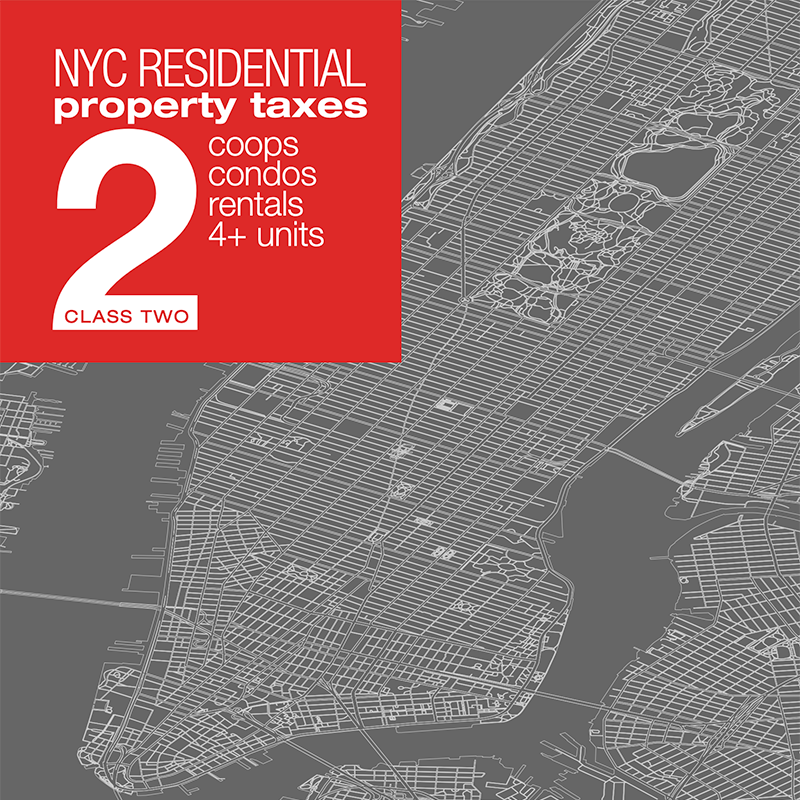

Nyc Residential Property Tax Guide For Class 2 Properties

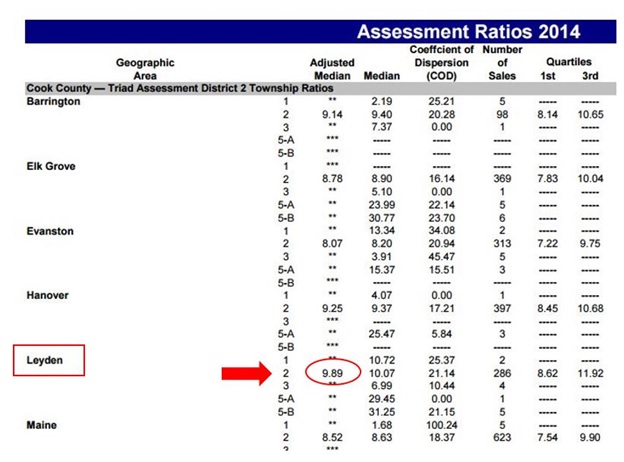

Calculate Your Community S Effective Property Tax Rate The Civic Federation

/https://www.thestar.com/content/dam/thestar/news/gta/2014/02/13/tab_for_torontos_not_especially_taxing_james/ciroysonfeb12.jpg)

Tab For Toronto Is Not Especially Taxing James The Star

With New Cuyahoga County Appraisals Most Property Tax Bills Will Rise See Partial Estimates For Your City Cleveland Com

This Is Where Toronto Ranks Vs Other Ontario Cities For Property Taxes

Council Directs Staff To Advertise A Ten Cent Increase On The Charlottesville Property Tax Rate Information Charlottesville